Are you on the fence aboutselling your house? Whileaffordabilityis improving this year, its still tight. And that may be on your mind. But understanding your home equity could be the key to making your decision easier. An article fromBankrateexplains:

Home equity is the difference between your homes value and the amount you still owe on your mortgage.It represents the paid-off portion of your home.

Youll start off with a certain level of equity when you make your down payment to buy the home, then continue to build equity as you pay down your mortgage. Youll also build equity over time as your homes value increases.

Think of equity as a simple math equation. Its the value of your home now minus what you owe on your mortgage. And guess what? Recently, your equity has probably grown more than you think.

In the past few years,home pricesskyrocketed, which means your homes value and your equity likely shot up, too. So, you may have more equity than you realize.

How To Make the Most of Your Home Equity Right Now

If youre thinking about moving, the equity you have in your home could be a big help.AccordingtoCoreLogic:

. . . the average U.S. homeowner with a mortgage stillhas more than $300,000 in equity. . .

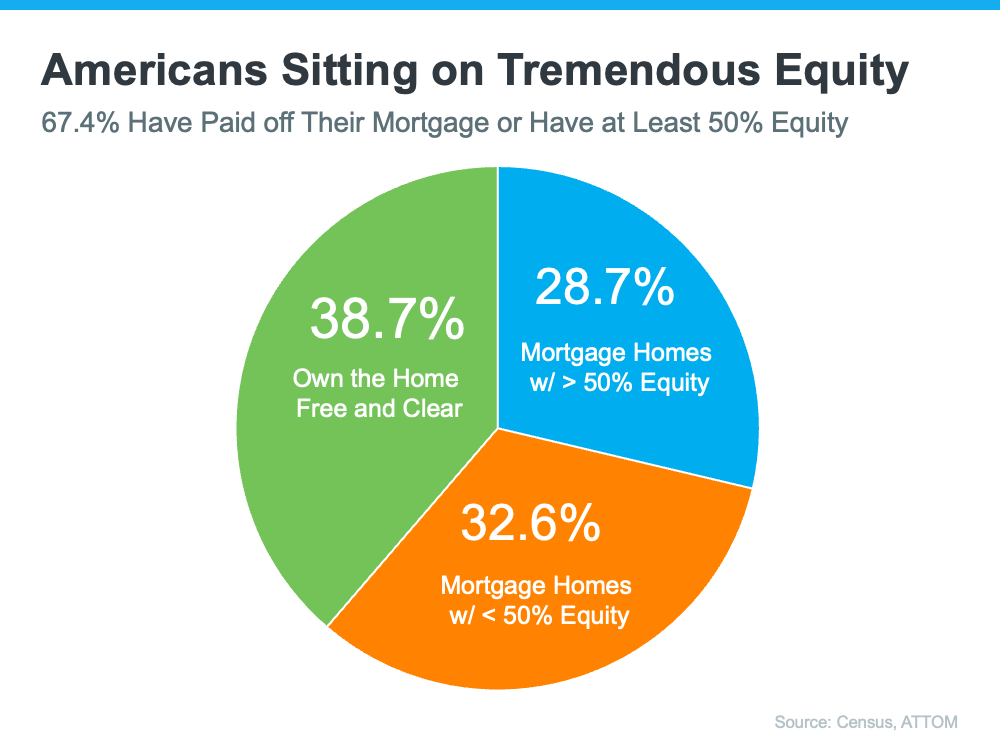

Clearly, homeowners have a lot of equity right now. And the latest data from theCensusandATTOMshows over two-thirds of homeowners have either completely paid off their mortgages (shown ingreen in the chart below) or have at least 50% equity (shown inblue in the chart below):

That means roughly 70% have a tremendous amount of equity right now.

After yousell your house, you can use your equity tohelp you buyyour next home. Heres how:

- Be an all-cash buyer:If youve been living in your current home for a long time, you might have enough equity to buy your next home without having to take out a loan. If thats the case, you wont need to borrow any money or worry aboutmortgage rates.Investopediastates:

You may want to pay cash for your home if youre shopping in a competitive housing market, orif youd like to save money on mortgage interest. It could help you close a deal and beat out other buyers.

- Make a larger down payment:Your equity could also be used toward your next down payment. It might even be enough to let you put a larger amount down, so you wont have to borrow as much money.The Mortgage Reportsexplains:

Borrowers who put down more money typically receive better interest rates from lenders.This is due to the fact that a larger down payment lowers the lenders risk because the borrower has more equity in the home from the beginning.

The Easy Way To Find Out How Much Equity You Have

To find out how much equity you have in your home, ask a real estate agent you trust for a Professional Equity Assessment Report (PEAR).

Bottom Line

Planning a move? Your home equity can really help you out. Call me, Marie McLaughlin at 727-858-7569 to see how much equity you have and how it can help with yournext home.

Source:https://www.keepingcurrentmatters.com/2024/02/08/home-equity-can-be-a-game-changer-when-you-sell/

Quick Search