Many consumers are wondering what will happen with home values over the next few years.Some are concerned that the recent run-up in home prices will lead to a situation similar to the housing crash 15 years ago.

However, experts say the market is totally different today. For example, Odeta Kushi, Deputy Chief Economist atFirst American,tweetedjust last week on this issue:

. . . We do need price appreciation to slow today (its not sustainable over the long run) but high price growth today is supported by fundamentals- short supply, lower rates & demographic demand. And we are in a much different & safer space: better credit quality, low DTI [Debt-To-Income] & tons of equity. Hence, a crash in prices is very unlikely.

Price appreciation will slow from the double-digit levels the market has seen over the last two years. However, experts believe home values willnotdepreciate (where a home would lose value).

To this point, Pulsenomicsjust released the latestHome Price Expectation Survey a survey of a national panel of over 100 economists, real estate experts, and investment and market strategists.Itforecasts home prices will continue appreciating over the next five years.Below are the expected year-over-year rates of home price appreciation based on the average of all 100+ projections:

- 2022: 9%

- 2023: 4.74%

- 2024: 3.67%

- 2025: 3.41%

- 2026: 3.57%

Those responding to the survey believe home price appreciation will still be relatively high this year (though half of what it was last year), and then return to more normal levels over the next four years.

What Does This Mean for You as a Buyer?

With a limited supply of homes available for sale and both prices and mortgage rates increasing, it can be a challenging market to navigate as a buyer. But buying a home sooner rather than later does have its benefits. If you wait to buy, youll pay more in the future. However, if you buy now, youll actually be in the position to make future price increases work for you. Once you buy, those rising home prices will help you build your homes value, and by extension, your own household wealth through home equity.

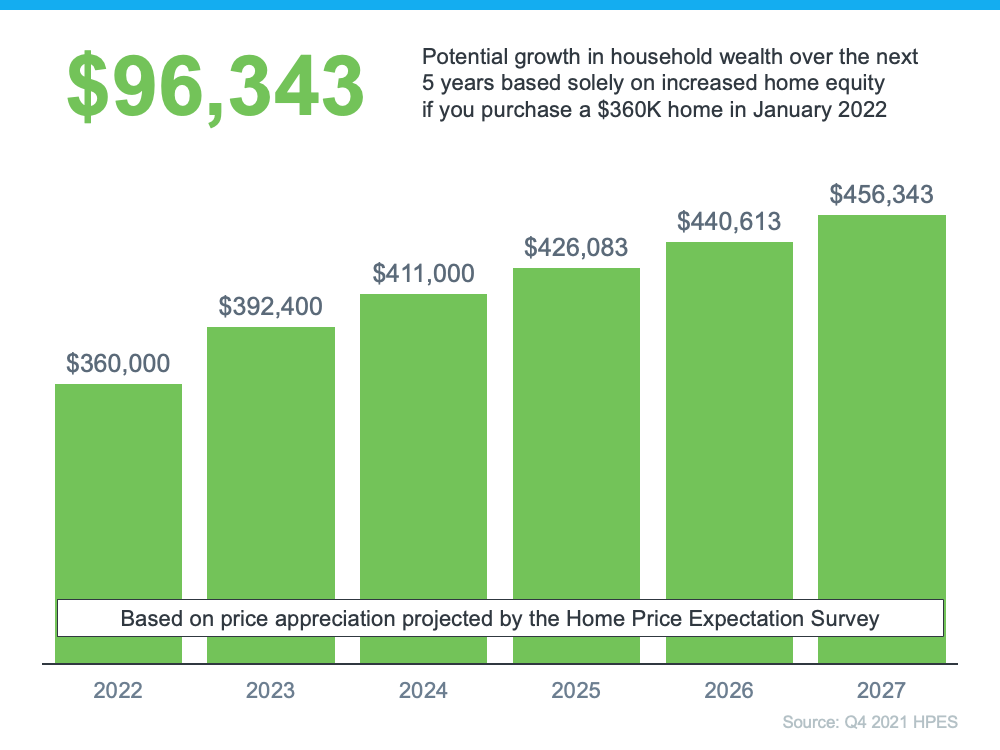

As an example, lets assume you purchased a $360,000 home in January of this year (themedian priceaccording to theNational Association of Realtorsrounded up to the nearest $10K). If you factor in the forecast for appreciation from theHome Price Expectation Survey, you could accumulate over $96,000 in household wealth over the next five years (see graph below):

Bottom Line

If youre trying to decide whether to buy now or wait, the key is knowing whats expected to happen with home prices. Experts say prices will continue to climb in the years ahead, just at a slower pace. So, if youre ready to buy, doing so now may be your best bet for your wallet. Itll also give you the chance to use the future home price appreciation to build your own net worth through rising equity. If you want to get started, lets connect today.

Its Still a Sellers Market

- Due tolow supplyand high demand, today is one of the strongest sellers markets weve seen.

- Sellers can benefit frommore offersto pick from,higher home values, and a faster sales process. Theres a reason why 72% of people believe its agood time to sell.

- Dont miss out on this unique opportunity. Lets connect so you can take advantage of this hot sellers market.

When you are ready to buy or sell your next home, please call me, Marie McLaughlin 727-858-7569.

Source: National Association of Realtors

Quick Search